Understanding the Importance of Creating a Wedding Budget

Planning a wedding is an exciting and joyous occasion, but it can also be overwhelming—especially when it comes to managing expenses. Creating a wedding budget from scratch is an essential first step in ensuring your special day is both memorable and financially manageable. A well-structured budget helps you prioritize spending, avoid unexpected costs, and keep stress levels in check.

With the right approach and tools, you can take control of your wedding finances and plan your dream event without breaking the bank. This comprehensive step-by-step guide will walk you through how to create a wedding budget from scratch, including the use of a free budgeting tool designed to simplify the process.

Step 1: Determine Your Total Wedding Budget

Before diving into specific expenses, establish your overall wedding budget. This is the total amount of money you have available to spend on every aspect of your wedding day, from the venue to floral arrangements.

Consider these factors when setting your budget:

- Personal Savings: How much money have you set aside for the wedding?

- Family Contributions: Will your family members contribute financially?

- Other Sources: Gifts, loans, or other income streams that may support your wedding.

Having a clear figure for your total budget will guide all planning decisions and keep your spending on track.

Step 2: List Every Possible Wedding Expense

Next, compile a comprehensive list of potential wedding expenses. Weddings consist of several elements, so listing them helps you visualize where your money will go. Typical categories include:

- Venue rental

- Catering and cake

- Wedding attire (dress, tuxedo, accessories)

- Photography and videography

- Floral arrangements and decorations

- Music and entertainment

- Invitations and stationery

- Transportation

- Officiant fees

- Wedding favors

- Hair and makeup

- Miscellaneous expenses (licenses, tips, contingency)

Research each element to get a rough cost estimate and include unexpected costs to avoid surprises later.

Step 3: Prioritize Your Spending

Every couple has different preferences and priorities when it comes to their wedding. Decide which aspects are most important to you both—such as an extravagant venue, gourmet catering, or professional photography—and allocate a larger portion of your budget accordingly.

Rank your categories from high to low priority. This method allows you to funnel more money into key elements while finding savings on less critical items. For example, if photography is a priority but flowers are less so, consider allocating a bigger budget share to your photographer.

Step 4: Use Our Free Wedding Budget Calculator Tool

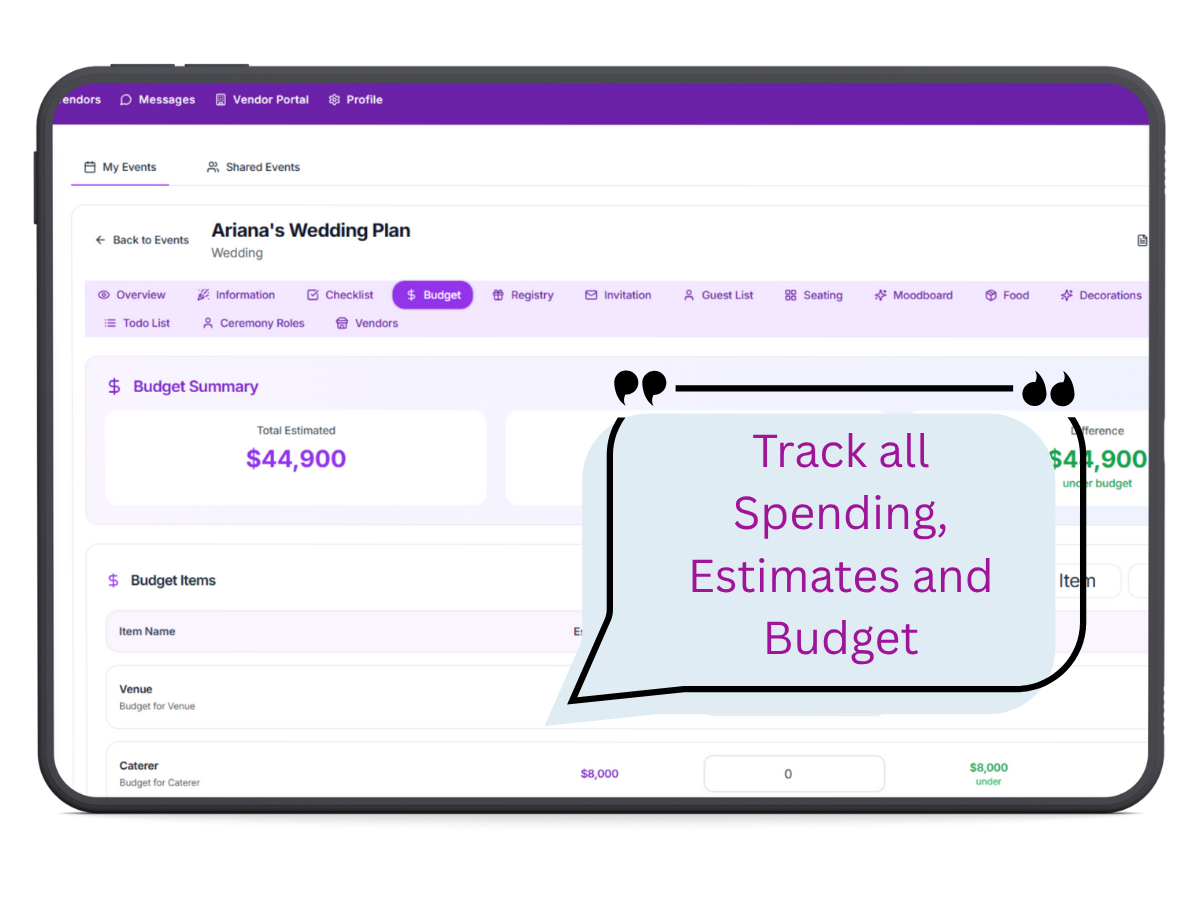

Managing numbers and estimates can get complicated, especially without budgeting experience. Luckily, a free wedding budget calculator tool simplifies the process by allowing you to input your total budget and desired categories. The tool then automatically breaks down how much you should ideally spend per category based on common wedding spending percentages.

Benefits of using the tool include:

- Instant budget breakdown tailored to your total budget

- Easy adjustments as your plans evolve

- Clear visualization of where your money is going

- Helps prevent overspending on any one element

This free tool can be accessed online and updated live as you book vendors or make decisions, helping you stay on track throughout the planning process.

Step 5: Set a Guest Count

The size of your wedding significantly impacts your budget. Guest count influences catering, venue size, invitations, and favors, making it one of the most important budget factors.

Start by drafting a guest list that reflects your budget constraints. If your budget is limited, consider a smaller, more intimate gathering. If you have flexibility, estimate the number of guests likely to attend. Adjust your budget calculator inputs accordingly to reflect the impact on costs.

Step 6: Research Vendor Prices and Get Quotes

Actual vendor prices can vary significantly depending on location, season, and demand. After prioritizing categories and estimating a budget, begin reaching out to local vendors for quotes:

- Request itemized quotes for catering packages, venue rentals, photography, and other key services

- Compare what different vendors include to get a better value

- Factor in taxes, fees, and gratuities when evaluating costs

Use this data to refine your budget estimates in the calculator tool and adjust spending allocations where necessary.

Step 7: Create a Detailed Wedding Budget Spreadsheet

A detailed spreadsheet is vital for managing the nuances of your wedding budget. Use columns for:

- Category

- Estimated cost

- Actual cost

- Paid amount

- Balance due

- Vendor contact details

Keeping records organized in one place helps you monitor progress, payment schedules, and vendor communications. The free budgeting tool can be complemented with an editable spreadsheet template tailored to your preferences.

Step 8: Build in a Contingency Fund

Unexpected expenses are common during wedding planning. Weather-related rentals, extra guest counts, or last-minute decoration changes can add extra costs. Experts recommend setting aside 5-10% of your total budget as a contingency fund to cover unforeseen expenses without compromising your event.

This safety net prevents stress and financial strain, allowing you to enjoy the lead-up to your big day with peace of mind.

Step 9: Track Payments and Deadlines

Vendor payments usually follow specific schedules, including deposits, milestone payments, and final balances. Keeping track of these deadlines avoids late fees or cancellations.

In your budget spreadsheet or tool, log payment due dates and set reminders. Confirm all payment methods accepted by vendors and keep receipts or confirmation emails organized.

Step 10: Regularly Review and Adjust Your Budget

Wedding plans evolve over time. As you book vendors and firm up details, regularly review your budget to ensure it reflects actual spending and updated expectations. Review the following monthly or after major decisions:

- Are you staying within category and total budget limits?

- Do you need to adjust expenses in any area?

- Have you added any new elements requiring funds?

- Is your contingency fund still sufficient?

Using the free wedding budget tool makes revisions easy and helps maintain financial control.

Tips for Staying on Budget While Planning Your Wedding

- Be realistic: Avoid setting unattainable budgets; account for all planned expenses.

- Prioritize: Focus on key items that matter most to you as a couple.

- Seek discounts and deals: Look for off-season rates, package deals, and referrals.

- Negotiate: Don’t hesitate to ask vendors if they can offer a better rate or added value.

- DIY selectively: Save by making your own invitations or decorations, but weigh time versus savings.

- Limit guest count: Smaller weddings drastically reduce costs on multiple fronts.

- Stay organized: Use your spreadsheet and budget tool consistently to avoid overspending.

Common Wedding Budget Mistakes to Avoid

- Underestimating costs: Research and realistic quotes prevent budget shock.

- Forgetting taxes and fees: Always include additional costs in your estimates.

- Overextending financially: Stick to your total budget; don’t rely on uncertain contributions.

- Neglecting contingency funds: Life is unpredictable—plan accordingly.

- Last-minute decisions: Rushed purchases can be expensive; plan well in advance.

- Ignoring payment schedules: Late payments can lead to penalties or lost deposits.

Conclusion

Creating a wedding budget from scratch might seem daunting at first, but following a structured, step-by-step approach makes it manageable and even enjoyable. By setting your budget, prioritizing spending, leveraging free tools, and staying organized, you put yourself in a great position to plan the wedding of your dreams without financial stress.

Remember to regularly review and adjust your budget as plans progress, and always factor in contingencies. This disciplined approach helps you control costs, make informed decisions, and ultimately celebrate your wedding day knowing you managed your finances wisely.