Should We Pay for Our Wedding Ourselves? A Guide for Couples

Planning a wedding can be one of the most exciting yet stressful experiences for couples. One of the most significant questions that arise during the wedding planning process is: should we pay for our wedding ourselves? This decision has a considerable impact on your budget, your relationship with your families, and the overall planning experience. In this guide, we will explore the pros and cons of self-funding your wedding, alternative funding options, and tips to manage wedding expenses effectively.

Understanding the Costs of a Wedding

Before deciding whether to pay for your wedding on your own, it’s essential to understand the typical costs involved in weddings. According to recent studies, the average wedding cost in the United States can range from $20,000 to $35,000, depending on location, number of guests, and the scale of the event.

Key expenses to consider include:

- Venue rental

- Catering and beverages

- Photography and videography

- Attire and accessories

- Decorations and floral arrangements

- Entertainment and music

- Wedding planning services

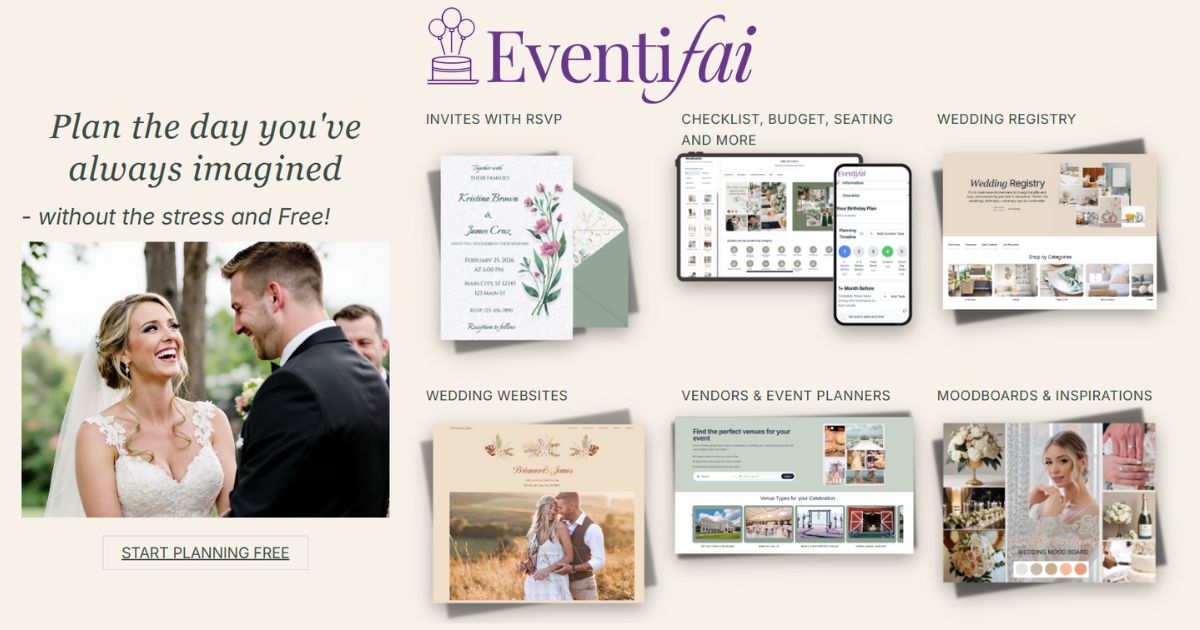

- Stationery, such as invitations and programs

Knowing the approximate costs upfront can help you make an informed decision about whether funding the wedding yourself is feasible or if you need assistance.

Advantages of Paying for Your Wedding Yourself

Many couples choose to pay for their wedding independently, and there are several benefits to this approach:

1. Full Control Over Decisions

When you pay for your own wedding, you have complete control over every aspect of the planning process. From the venue to the guest list, you can shape your special day exactly as you envision it without external pressure.

2. Freedom from Family Obligations

Self-financing your wedding can minimize potential conflicts with family members who might want to influence decisions based on their financial contribution. This autonomy can streamline decision-making and reduce stress.

3. Opportunity to Budget Wisely

Paying for your wedding yourself encourages careful budgeting and prioritization. You can allocate your resources to the areas that matter most to you, whether it’s the food, photography, or entertainment.

4. Builds Financial Responsibility

Funding your wedding independently can help you and your partner develop strong financial planning skills that will benefit your marriage beyond the wedding day.

Challenges of Paying for Your Wedding Independently

While self-funding has many advantages, there are some challenges couples should consider:

1. Financial Stress

Weddings can be expensive, and paying out-of-pocket may lead to financial strain or debt if not carefully managed. It’s important to evaluate your savings and monthly budgets before committing.

2. Limited Budget

Without family contributions, your overall wedding budget might be smaller, which could limit options for venues, vendors, and guest experiences.

3. Possible Sacrifices

Self-paying couples often have to make compromises, such as reducing the guest list or spending less on extras like décor or entertainment, to stay within budget.

4. Time Investment

Managing the entire wedding budget and payments yourself demands time and effort, which can add stress to an already busy planning schedule.

Alternative Wedding Funding Options

If paying entirely for your wedding isn’t feasible, there are other ways to share the financial responsibilities:

1. Family Contributions

Traditionally, the bride’s family paid for the majority of the wedding costs, but modern weddings often involve contributions from both sides or other relatives. Open and honest communication about finances with family members can help avoid misunderstandings.

2. Wedding Loans

Some couples consider personal loans or wedding loans to help cover expenses. While this can boost your budget, it’s crucial to understand the repayment terms and avoid high-interest debt.

3. Crowdfunding

Online platforms have made it easier to crowdsource wedding funds from friends and family. This approach works best when contributors are comfortable and excited to support your celebration.

4. Employer Benefits or Savings Accounts

Look for creative options like employer wedding bonuses, if available, or make use of specialized savings accounts such as a dedicated wedding fund to accumulate money over time.

Tips for Couples Paying for Their Own Wedding

If you decide to pay for your wedding yourselves, here are some practical tips to stay on track financially:

1. Create a Realistic Budget

Start by listing all expected expenses and setting limits for each category. Use budgeting tools or apps to track your spending throughout the planning process.

2. Prioritize What Matters Most

Decide early on the elements of your wedding that are most important to you both—whether it’s food quality, entertainment, or photography—and allocate funds accordingly.

3. Consider Off-Peak Dates and Locations

Weddings held on weekdays, Sundays, or during off-peak seasons can be significantly less expensive than weekend or summer events.

4. DIY When Possible

Use your creativity and skills—or those of your friends and family—to handle decorations, invitations, or favors, reducing vendor costs.

5. Limit the Guest List

Reducing the number of guests can significantly lower catering, venue, and other per-person costs.

6. Get Multiple Quotes and Negotiate

Always shop around for vendors and don’t hesitate to negotiate prices or packages to maximize your budget.

7. Build an Emergency Fund

Set aside a portion of your budget for unexpected expenses that may arise during planning or on the wedding day.

Communicating About Wedding Finances

Whether you are self-funding or involving family contributions, transparent communication is vital.

1. Talk Early and Often

Discuss finances early in the planning stage to set expectations and avoid surprises. This includes conversations between partners as well as with families.

2. Establish Roles and Responsibilities

Clarify who is responsible for which expenses and payments to minimize confusion and potential conflicts.

3. Keep Track of Contributions

If multiple parties are contributing, maintain a clear record of what each person or family has committed to pay for, ensuring fairness.

How Paying for Your Wedding Affects Your Relationship

Money matters can influence relationships, and planning a wedding is no exception. Couples who pay for their own weddings often experience both challenges and rewards:

- Increased teamwork: Collaborating on budgeting and planning can strengthen your partnership.

- Financial transparency: Handling expenses together fosters open communication about finances.

- Stress management: Budget constraints may create tension; learning to manage this gracefully is key.

Keep in mind that clear communication and mutual respect will help navigate any potential financial stress.

Wrapping Up: Is Self-Paying for Your Wedding the Right Choice?

Deciding whether to pay for your wedding yourselves depends on your financial situation, family relationships, and personal preferences. Here’s a quick summary of factors to consider:

- Budget flexibility: Can you afford to self-fund without jeopardizing your financial future?

- Desired level of control: Do you prefer to make all decisions independently?

- Family dynamics: Are relatives supportive or involved in the planning?

- Stress tolerance: Are you comfortable managing both logistics and finances?

Ultimately, your wedding should reflect your love and commitment, regardless of how it’s funded. Careful planning and open communication will help you create a memorable and meaningful day within your means.